The Ultimate Guide to Special Needs Trusts: Discover the Key Benefits

Introduction:

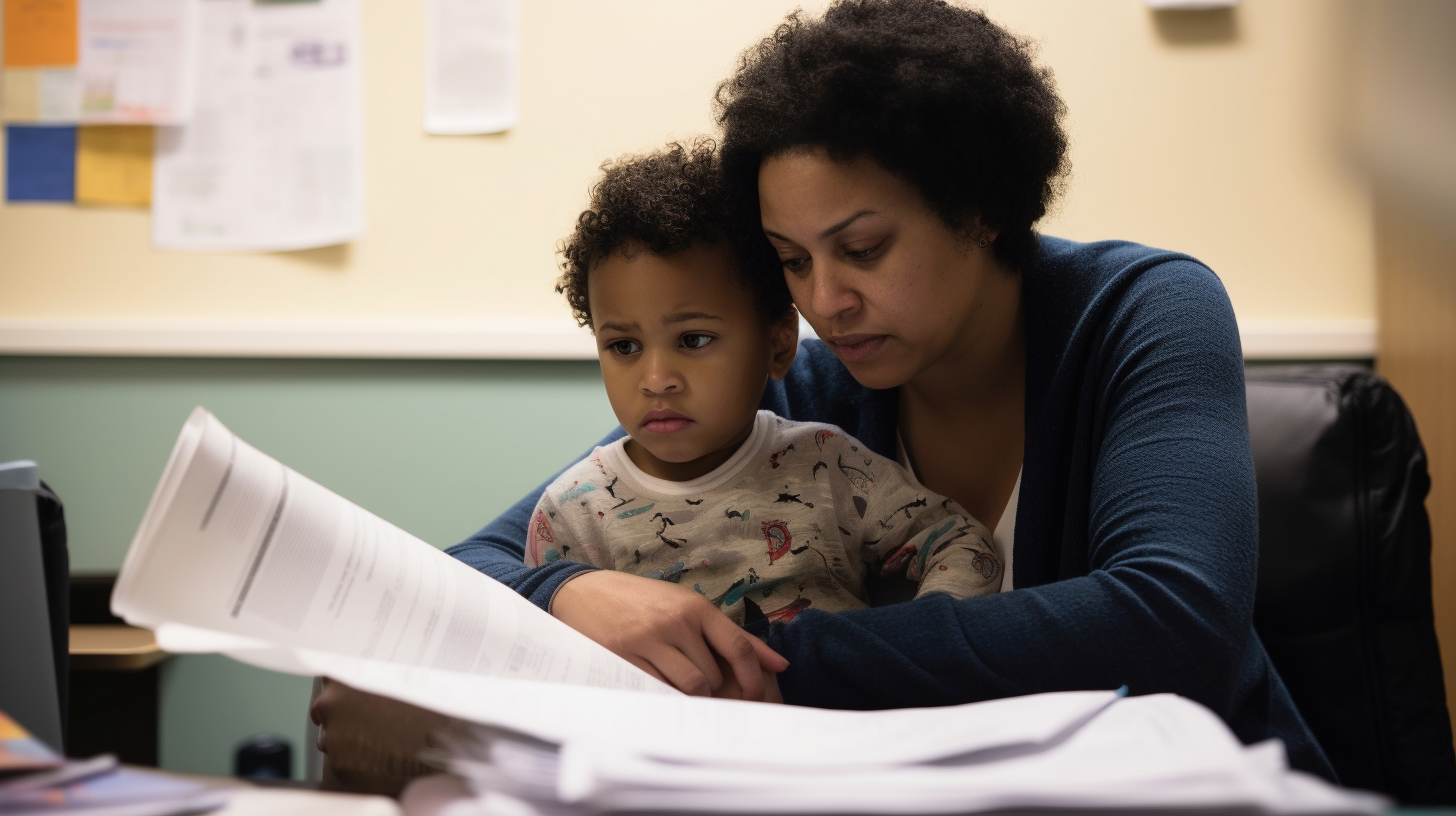

Welcome to “The Ultimate Guide to Special Needs Trusts: Discover the Key Benefits.” If you have a loved one with special needs, you understand the unique challenges and responsibilities that come with providing for their long-term financial security. In this guide, we will explore the benefits of a special needs trust and how it can offer peace of mind and financial stability for individuals with special needs and their families.

Understanding Special Needs Trusts

A special needs trust is a legal arrangement designed to protect the financial well-being of individuals with disabilities or special needs. It allows parents, guardians, or other family members to set aside funds for the future care and support of their loved ones without jeopardizing their eligibility for government benefits.

There are three main types of special needs trusts:

- First-party special needs trust: This type of trust is funded with the disabled individual’s own assets, such as an inheritance or personal injury settlement.

- Third-party special needs trust: This trust is established by someone other than the disabled individual, typically a parent or grandparent. It is funded with the assets of the person creating the trust.

- Pooled special needs trust: A pooled trust is managed by a nonprofit organization and allows multiple beneficiaries to pool their resources together for investment purposes.

The Key Benefits of a Special Needs Trust

Now that we have a basic understanding of what a special needs trust is, let’s explore its key benefits:

1. Protecting Government Benefits

A primary benefit of a special needs trust is that it allows individuals with disabilities to maintain eligibility for crucial government benefits such as Supplemental Security Income (SSI) and Medicaid. These benefits provide essential financial support for medical care, housing, and daily living expenses.

Without a special needs trust, an individual’s assets, including inheritance or personal injury settlements, could disqualify them from receiving these vital benefits. By placing funds in a special needs trust, the assets are not considered as belonging to the individual and do not affect their eligibility for government assistance.

2. Ensuring Quality of Life

A special needs trust can help ensure that individuals with disabilities enjoy a high quality of life by providing additional financial resources beyond what government benefits cover. The trust can be used to pay for various expenses that enhance their well-being, including:

- Medical treatments and therapies not covered by insurance

- Specialized equipment such as wheelchairs or communication devices

- Home modifications to improve accessibility

- Education and vocational training

- Recreational activities and vacations

These additional funds can greatly enhance the individual’s independence, opportunities, and overall happiness.

3. Providing Financial Security

A special needs trust offers long-term financial security for individuals with disabilities, even after their parents or caregivers are no longer able to provide direct support. The trust ensures that funds are managed by a trustee who has the beneficiary’s best interests at heart.

The trustee oversees the distribution of funds according to the guidelines set forth in the trust document. This arrangement provides peace of mind to parents or caregivers knowing that their loved one will have ongoing financial support and will be protected from financial exploitation.

4. Preserving Family Harmony

Caring for a family member with special needs can sometimes create tension and disagreements within families, particularly when it comes to financial matters. Establishing a special needs trust can help alleviate these concerns by providing a clear plan for the management and distribution of funds.

The trust document outlines the beneficiary’s specific needs, preferences, and how the funds should be used. This helps prevent misunderstandings or conflicts among family members regarding the allocation of resources, ensuring that everyone is aligned with the beneficiary’s best interests.

5. Tax Benefits

Special needs trusts may also offer tax advantages to both the donor and the beneficiary. Income generated by the trust is typically not taxable if used for qualified disability expenses. Additionally, donors may be eligible for tax deductions or exclusions when contributing to a special needs trust.

Challenges and Considerations

While special needs trusts offer numerous benefits, there are some challenges and considerations to keep in mind:

1. Legal Assistance

Creating a special needs trust requires legal expertise to ensure compliance with state laws and regulations. It’s crucial to consult with an attorney experienced in special needs planning to draft a comprehensive trust document that meets your loved one’s unique circumstances.

2. Choosing the Right Trustee

Selecting a trustworthy trustee is essential for the success of a special needs trust. The trustee should have knowledge of your loved one’s specific needs, financial acumen, and the ability to make sound decisions in their best interest. It’s important to carefully consider potential trustees and discuss your expectations with them.

3. Regular Review and Updates

A special needs trust should be regularly reviewed and updated as circumstances change over time. This includes changes in government benefit programs, family dynamics, or financial situations. Periodic reviews ensure that the trust remains effective and aligned with the beneficiary’s evolving needs.

Conclusion

A special needs trust is a powerful tool that can provide financial security, protect government benefits, and enhance the quality of life for individuals with disabilities. By understanding the benefits and challenges associated with special needs trusts, you can make informed decisions to safeguard your loved one’s future.

Consulting with an experienced attorney specializing in special needs planning is crucial to ensure that your trust is properly established and tailored to your family’s unique circumstances. With careful planning and consideration, a special needs trust can offer peace of mind and a brighter future for individuals with special needs.