Creating a Comprehensive Financial Plan for Families with Special Needs

Introduction:

Creating a Comprehensive Financial Plan for Families with Special Needs

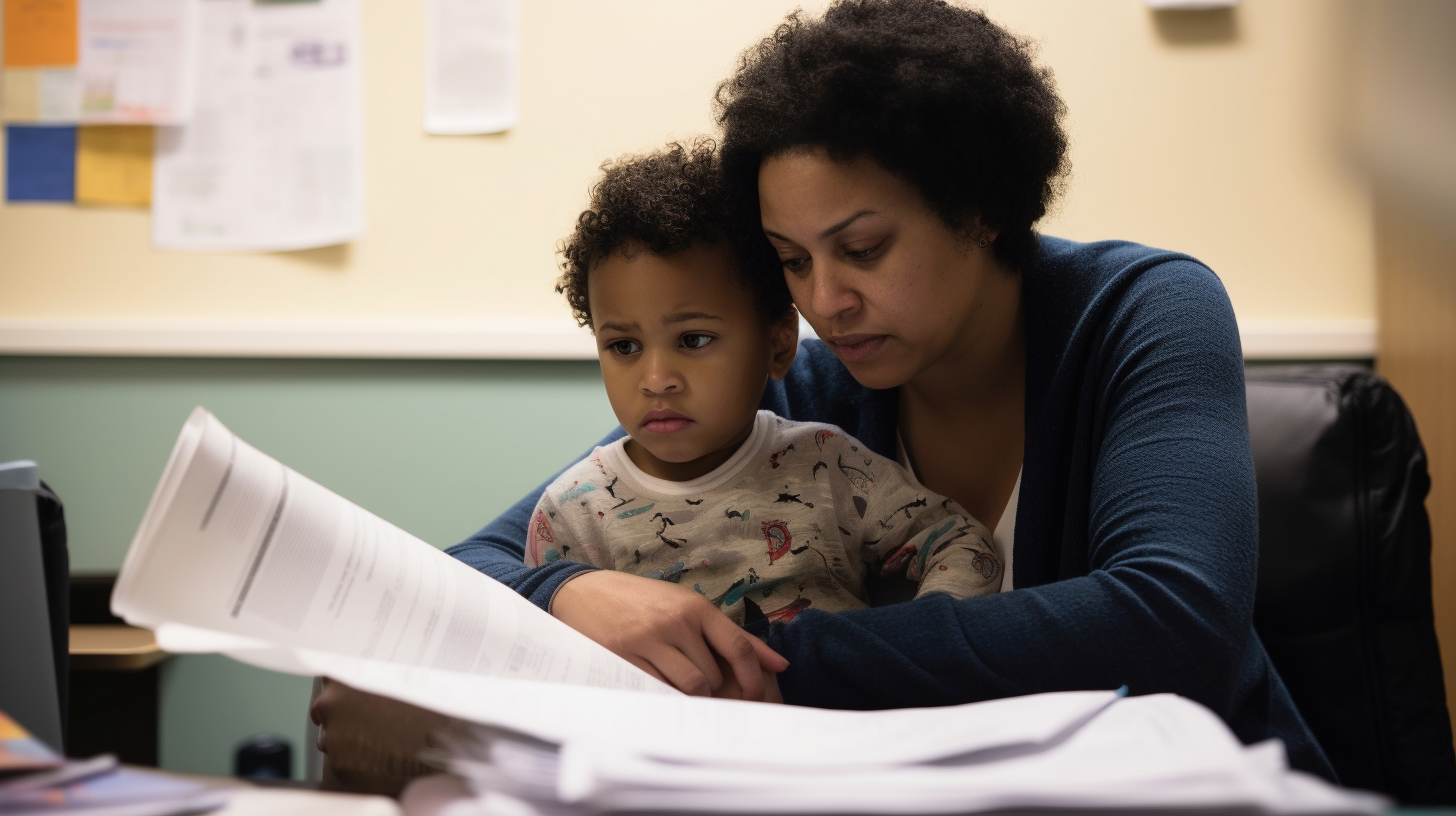

Raising a child with special needs comes with unique challenges and responsibilities, including the need for a comprehensive financial plan. Parents or caregivers of special needs individuals often face the daunting task of ensuring their loved one’s long-term financial stability and security. From medical expenses to therapies, education, and guardianship arrangements, there are numerous financial considerations that require careful planning and preparation.

In this blog post, we will explore the importance of creating a comprehensive financial plan for families with special needs. We will discuss the benefits and challenges associated with this process, as well as provide practical tips and solutions to help you navigate the complexities of special needs financial planning. By the end of this article, you will have a clear understanding of how to approach and implement a financial plan that addresses the specific needs of your special needs family member.

The Benefits of Creating a Financial Plan for Special Needs Families

A comprehensive financial plan tailored to the unique circumstances of your special needs family member can provide numerous benefits:

- Financial Security: A well-designed financial plan ensures that your loved one’s future needs are adequately addressed, providing peace of mind for both you and your family member.

- Budgeting and Expense Management: A financial plan helps you establish a realistic budget that takes into account ongoing expenses related to medical care, therapies, education, and other essential services.

- Maximizing Government Benefits: Understanding government assistance programs can help you navigate the complex eligibility requirements and ensure your loved one receives all available benefits.

- Estate Planning: A comprehensive financial plan includes provisions for estate planning, such as establishing trusts or guardianship arrangements, to protect your special needs family member’s assets and ensure their ongoing care.

- Long-Term Financial Stability: By implementing a financial plan, you can work towards building a secure financial future for your special needs family member, even after you are no longer able to provide direct support.

The Challenges of Creating a Financial Plan for Special Needs Families

While the benefits of creating a financial plan are significant, it is essential to acknowledge and address the unique challenges faced by families with special needs individuals:

- Complexity: Special needs financial planning involves navigating complex legal and financial systems, including government benefits programs and estate planning laws.

- Uncertainty: The future needs and requirements of your special needs family member may be uncertain, making it challenging to anticipate and plan for all potential scenarios.

- Emotional Considerations: Planning for the long-term financial well-being of your special needs family member can be emotionally challenging. It is crucial to balance practical considerations with empathy and sensitivity.

- Financial Resources: Providing for the present and future needs of a special needs individual requires careful financial management and access to appropriate resources.

Tips for Creating a Comprehensive Financial Plan for Special Needs Families

To help you navigate the process of creating a comprehensive financial plan, we have compiled the following tips:

- Educate Yourself: Take the time to educate yourself about government benefits programs, estate planning laws, and other relevant financial considerations. Consult trusted resources such as disability organizations or financial planners specializing in special needs planning.

- Identify Your Loved One’s Needs: Assess your loved one’s current and future needs, including medical care, therapies, education, housing, and support services. Consider consulting with professionals such as doctors, therapists, or educators to gain a comprehensive understanding of their requirements.

- Create a Budget: Develop a realistic budget that takes into account all ongoing expenses related to your special needs family member’s care. Consider factors such as medical costs, therapies, assistive devices, educational support, and recreational activities.

- Explore Government Benefits: Research and understand the government benefits available for individuals with special needs. This may include Supplemental Security Income (SSI), Medicaid waivers, or other programs specific to your region. Work with professionals who can guide you through the application process.

- Consider Special Needs Trusts: Investigate the benefits of establishing a special needs trust. A trust can protect your loved one’s assets without jeopardizing their eligibility for government benefits.

- Review Insurance Coverage: Evaluate your existing insurance coverage to ensure it adequately addresses the specific needs of your special needs family member. This may include health insurance, life insurance, or disability insurance.

- Plan for the Future: Establish long-term plans for guardianship arrangements and transition planning. Consider who will assume responsibility for your loved one when you are no longer able to provide direct care.

Remember that every family’s situation is unique, and it is crucial to consult with professionals specializing in special needs financial planning. They can provide personalized advice based on your specific circumstances and guide you through the process of creating a comprehensive financial plan.

In Conclusion

A comprehensive financial plan is an essential tool for families with special needs individuals. It provides financial security, ensures ongoing care and support, and maximizes government benefits. While the challenges may be significant, with proper education, planning, and professional guidance, you can create a financial plan that addresses the specific needs of your special needs family member.

Take the first step today by educating yourself about the available resources and consulting with experts in special needs financial planning. By doing so, you are paving the way for a secure financial future for your loved one and peace of mind for your entire family.